Call

+91 7021135860

Products

SmartBanker Plus

In today’s competitive environment, small, medium and large banks are facing primarily 4 common business challenges, viz

- Acquiring new customers through a cost-effective process (e.g. CASA & Loan Accounts),

- Selling new products & services to existing customers. (e.g. Insurance, MFs etc).

- Servicing existing customers in a better way. (e.g. Doorstep Banking).

- Regulatory Compliance for KYC and Re-KYC, including Aadhaar Seeding to CBS

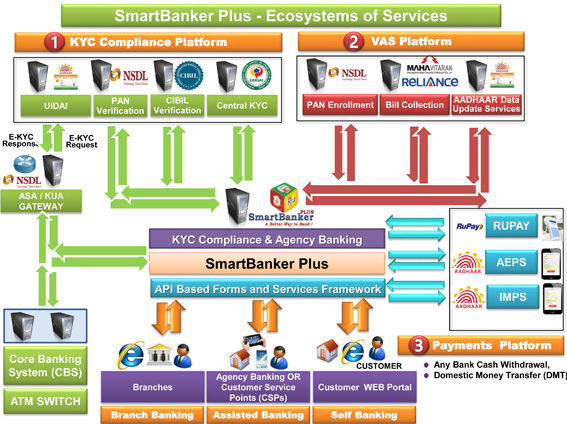

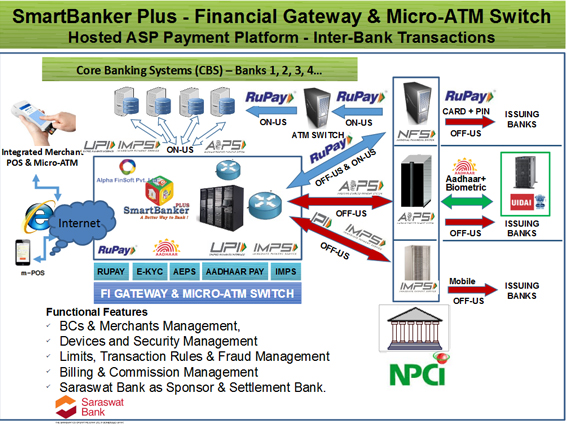

Alpha FinSoft Pvt. Ltd. is pleased to release a common business solution to above challenges. The entire business approach is supported by unified technology solution platform “SmartBanker Plus” available to banks, financial institutions and telecom companies. The product has been designed and developed by Microsoft Solution Partner M/S Alpha FinSoft Pvt. Ltd. for the WEB, Tablets and Mobiles. The Platform supports, In-Branch, WEB based or Off-Branch, Mobile or Micro-ATM based business scenarios.

About SmartBanker Plus

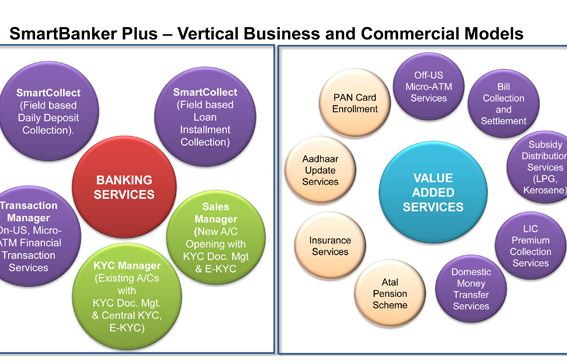

- SmartBanker Plus is comprehensive KYC Compliance and ‘Doorstep Financial Services Platform’, supporting “Agency Banking” Model.

- Supports PC-WEB at Branches or Tablet-based Micro-ATMs for Agents’ or Business Correspondents’ (BC) based operations.

- Business model supports, Customer On-boarding, Account Opening, Financial Transactions, On-line, Off-line E-Wallets and Value Added Services, e.g. Bill Collections, Loan Recovery, PM Yojanas (Schemes) etc.

- Centrally Managed Limits Management, Transaction Validation & Settlement Rules.

- Off-line” or “On-line”, Mobile App and data Sync support.

- Agent wise, Branch wise Batch Closure and Settlement with consolidation at Central Office.

- Centralized or decentralized Back-Office Business Process Operations.

- Fully enabled for regulatory KYC compliance, supporting Aadhaar (E-KYC) & non-Aadhaar customers. Complies with both Regulatory & UIDAI’s Audit & Certification processes.

- Available as “Data Center Solution” or SaaS (ASP) Services.

- Ready integration framework with multiple Core Banking Systems (CBS) providers.

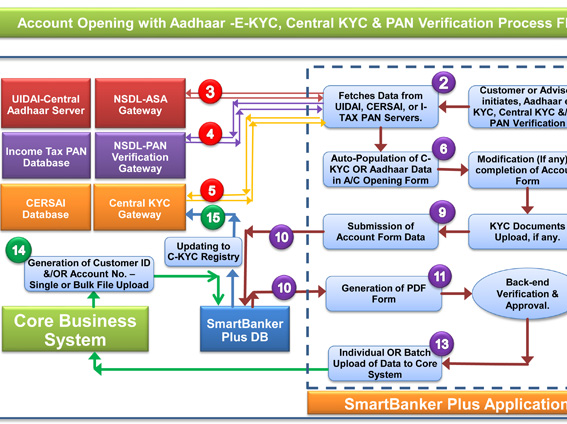

- KYC

- Unified KYC Compliance with De-Dupe Check.

- Auto-population of E-KYC OR C-KYC Data into Account Opening Form.

- Auto-population of E-KYC Data in C-KYC Form

- Aadhaar based E-KYC and Authentication (UIDAI).

- Central KYC (CERSAI) interfaces (New, Update or Existing C-KYC Data Upload & Download, Existing CBS Customer C-KYC Data Upload & Download)

- PAN Verification.

- KYC Document Management & CIBIL Credit Verification Platform.

- E-SIGN

- eSign is an online electronic signature service in India to facilitate an Aadhaar holder to digitally sign a document. The signature service is facilitated by authenticating the Aadhar holder via the Aadhar-based e-KYC (electronic Know Your Customer) service.

To eSign a document, one has to have an Aadhaar card and a mobile number registered with Aadhaar. With these two things, an Indian citizen can sign a document remotely without being physically present.

Issuance of digital signature certificate by shall be based on e-authentication, particulars given in the prescribed format, digitally signed verified information from Aadhaar e-KYC services and electronic consent of digital signature certificate applicant

The manner in which information is authenticated by means of digital signature shall comply with the standards specified in rule 6 of the Information Technology Rules, 2000 in so far as they relate to the creation, storage and transmission of Digital Signature.

- eSign is an online electronic signature service in India to facilitate an Aadhaar holder to digitally sign a document. The signature service is facilitated by authenticating the Aadhar holder via the Aadhar-based e-KYC (electronic Know Your Customer) service.

- Payment Platform

Micro-ATM(BC Model) Transaction Types Supported:

- Cash Deposit

- Withdrawal

- Balance Inquiry

- Statement

- Domestic Money Transfer

Transaction Types Supported:

- Aadhaar (Fingerprint, OTP) - NSDL

- Central Biometric Registration Server,

- Mobile OTP

- Rupay, MC, Visa - Debit or Credit Card + PIN - MSR & EMV Smart Card

- Aadhaar Enabled Payment System (AEPS) – NPCI

M-POS(Mobile POS) Transaction Types Supported:

- Sale (Purchase)

Authentication Methods Supported:

- IMPS – UPI (Mobile enabled Payments)

- Rupay, MC, Visa; - Debit & Credit Card; - PIN - MSR & EMV Smart Card

Merchant POS Transaction Types Supported:

- Sale (Purchase)

Authentication Methods Supported:

- IMPS – UPI (Mobile enabled Payments)

- Rupay, MC, Visa; - Debit & Credit Card; PIN - MSR & EMV Smart Card

- Aadhaar PAY- based on AEPS

CONTACT US

Development Center & Marketing Office

12/2, 3rd Floor, Chandrodaya Society, Swastik Park,

Chembur, Mumbai 400 071. INDIA.

Phone : +91 7021135860

Email : sales@alphafinsoft.in