Call

+91 7021135860

Products

ID Junction

Small, medium and large institutions are facing primarily 4 common business challenges, viz.

- Authentication of User or Citizen for services subscription

- Regulatory Compliance for KYC and Re-KYC.

- Identification of the Citizens based on Government Records for servicing Customers / Citizens in a better way. ( e.g. Doorstep Banking or Customer Service Points)

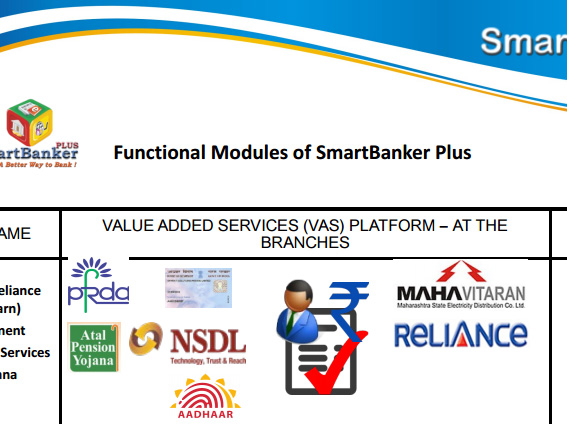

- Selling new Products & Services to existing customers to increase Fee Based Income. (e.g. Value Added Services such as Bill Collections, Insurance, MF, PAN, AADHAAR etc.

Meeting Banking Business Challenges

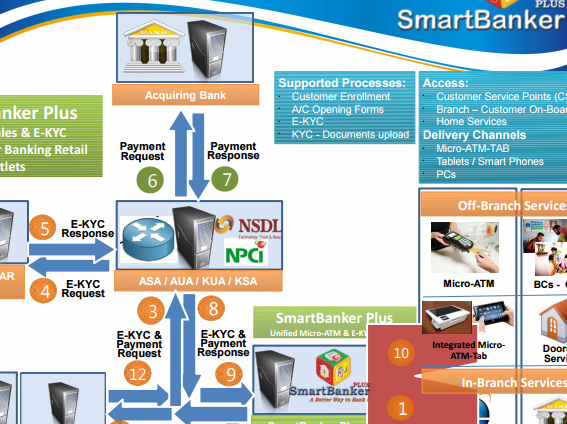

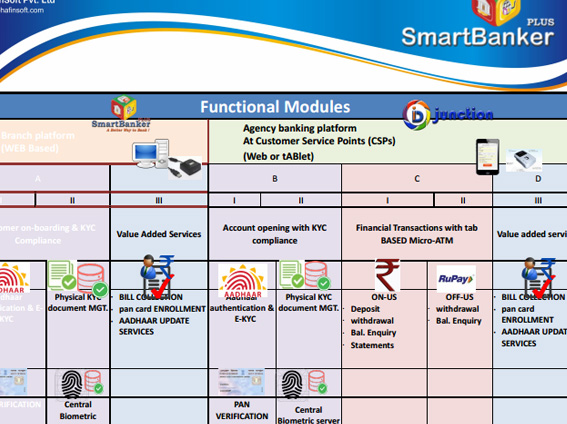

- “IDJunction” provides Aadhaar and PAN based authentication and validation Services, Aadhaar - E-KYC on a hosted ASP model.

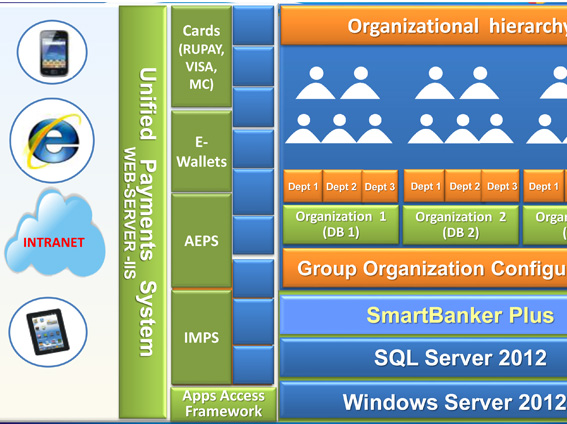

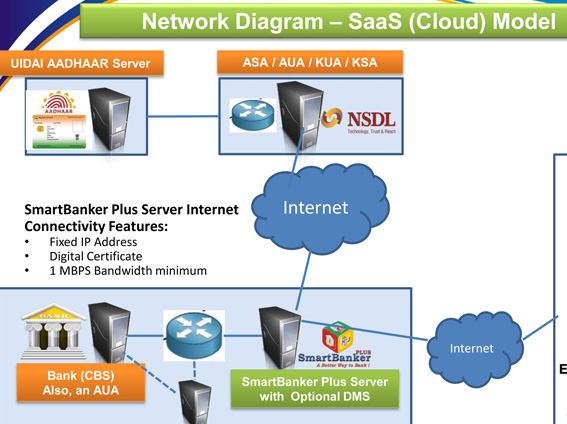

- The Platform can further be extended as a “SmartBanker” Solution Platform for the complete “Agency Banking” Services on a Data Center Model.

- The applicability of the Platform would be with following industry segments:

| » Banking Services | » Marriage Portals |

|---|---|

| » Financial & Securities Industry (Mutual Funds & Brokers) | » Government’s Citizen Services |

| » Insurance Services | » Education and Examination Segments |

- Hosted ASP Model for Identity and Authentication Services @ https://idjunction.com/yourorgname

- Small institutions can quickly get started on the services, without any technical infrastructure.

- The Platform offers “Aadhaar Authentication”; “Aadhaar E-KYC” and “PAN Verification” Services with one-time sign-up fee plus low cost monthly fee model.

- Technology infrastructure and management support through Alpha FinSoft Pvt. Ltd.

- In Stage II, Institutions can move to “SmartBanker Plus” or “SalesConnect Plus” Platform, with in-house Data-Center Model, to support KYC Document Management Model with paperless KYC.

- ID-JUNCTION is also available as ready platform for Data Center Services Providers, Financial Institutions, for offering services to their prospective AUAs, KUAs and Sub-AUAs.

- ID-JUNCTION is fully enabled for Web & Android based Smart Phones or Tablets.

MODULES OF ID JUNCTION

1. Aadhaar based Identity Authentication & Address Verification:

- Aadhaar Authentication & Address Verification is the process, wherein the Aadhaar Number, plus other attributes, e.g. Name, Biometrics (Proof of Identity), OR Address, (PoA), are submitted online to UIDAI’s Central Depository for its verification or authentication (Yes / No).

- The inputs are matched against the stored data with UIDAI, which was provided by the resident during enrolment/update process to UIDAI.

- Alternatively, authentication can also be carried out on the basis of mobile OTP, linked to Aadhaar No, during enrollment.

- The Unique Identification (Aadhaar) Number, which identifies a resident, thus together provides Proof of Identity (PoI) & Proof of Address (PoA), verification.

- Aadhaar Authentication Usage & Benefits

- For Banking Institutions:

- Avoids rejections from government Agencies for Direct Benefits or subsidies transfer by pre-authentication.

- Provides authentic Aadhaar seeding or linking of Aadhaar no. to Core Financial Systems data of the Customer such as Customer ID.

- For existing CBS customers’ Authentication through bulk upload to UIDAI Server.

- For Financial Services Entities: Mutual Funds, Insurance, Securities Trading and Brokerage Houses, NBFCs, Housing Finance Companies.

- For Other Entities: Employment Verification Agencies, E-commerce Portals, Educational Institutions, Marriage Portals.

- Provides unique way to verify identity of the person with address verification based on Aadhaar number along with other attributes.

- Unique access for on line, searchable reports with back-up on local server, with user & administrative access rights.

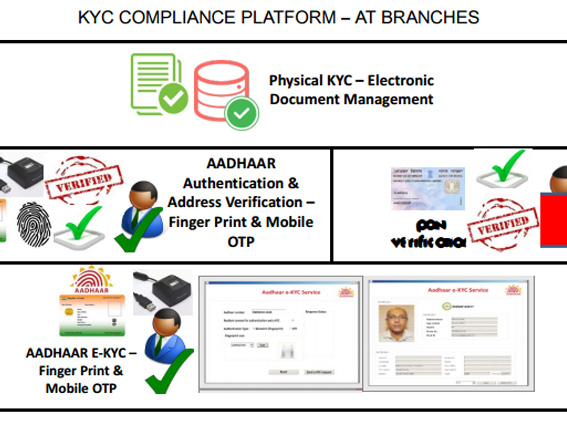

2. Aadhaar based E-KYC at ID JUNCTION

- Aadhaar based e-KYC Service provides a one click process for verification of Proof of Identity (PoI) and Proof of Address (PoA) in the electronic format.

- RBI, SEBI, IRDA, PFRDA, NHB, TRAI have endorsed E-KYC services as valid KYC compliant electronic model vide respective notifications

- The E-KYC services support Aadhaar based, biometric fingerprint Authentication, Identification & Address Verification of the customer as per respective regulatory notifications.

Aadhaar E-KYC Usage & Benefits:

- The Process eliminates the need for physical KYC documents to be carried by the customers and for the Institution reduces maintenance towards physical KYC documents.

- Reduces the risk of identity fraud, document forgery and completes paperless KYC verification by uniquely authenticating and identifying the customer through fingerprint identification vis-à-vis original Aadhaar registered record. This simplifies regulatory compliance process & potential fines for non-compliance

- Streamlines Account Opening Process flow, by auto-populating the E-KYC Data in the customer Account Opening Form.

3. PAN Verification:

- Online PAN Number Verification facility provides the status of PAN (Valid/Fake/Not present, in Income Tax Database) and Name of PAN holder.

- This helps the institution to ensure genuineness of the PAN provided and fulfill Know Your Customer (KYC) Norms/Anti-Money Laundering (AML) Standards/Combating of Financing of Terrorism (CFT) under Prevention of Money Laundering Act (PMLA) 2002

CONTACT US

Development Center & Marketing Office

12/2, 3rd Floor, Chandrodaya Society, Swastik Park,

Chembur, Mumbai 400 071. INDIA.

Phone : +91 7021135860

Email : sales@alphafinsoft.in